-

Business valuations

We offer expert valuation advice in transactions, regulatory and administrative matters, and matters subject to dispute – valuing businesses, shares and intangible assets in a wide range of industries.

-

Capital markets

You need corporate finance specialists experienced in international capital markets on your side if you’re buying or selling financial securities.

-

Complex and international services

Our experience of multi-jurisdictional insolvencies coupled with our international reputation allows us to deliver the best possible outcome for all stakeholders.

-

Corporate insolvency

Our corporate investigation and recovery teams can help you manage insolvency situations and facilitate the best outcome.

-

Debt advisory

An optimal funding structure for your organisation presents unprecedented opportunities, but achieving this can be difficult without a trusted advisor.

-

Expert witness

Our expert witnesses analyse, interpret, summarise and present complex financial and business-related issues which are understandable and properly supported.

-

Financial models

A sound financial model will help you understand the impact of your decisions before you make them. Talk to us about our user-friendly models.

-

Forensic and investigation services

We provide investigative accounting and litigation support services for commercial, matrimonial, criminal, business valuation and insurance disputes.

-

Independent business review

Is your business viable? Will it remain viable in the future? A thorough independent business review can help your organisation answer these fundamental questions.

-

IT forensics

Effective ESI analysis is integral to the success of your business. Our IT forensics experts have the technical expertise to identify, preserve and interrogate electronic data.

-

Mergers and acquisitions

Grant Thornton provides strategic and execution support for mergers, acquisitions, sales and fundraising.

-

Raising finance

Raising finance - funders value partners who can deliver a robust financial model, a sound business strategy and rigorous planning. We can guide you through the challenges that these transactions can pose and help you build a foundation for long term success once the deal is done.

-

Relationship property services

Grant Thornton offers high quality independent advice on the many financial issues associated with relationship property from considering an individual financial issue to all aspects of a complex settlement.

-

Restructuring and turnaround

Grant Thornton’s restructuring and turnaround service capabilities include cash flow, liquidity management and forecasting; crisis and interim management; financial advisory services to companies and parties in transition and distress

-

Transaction advisory

Our depth of market knowledge will steer you through the transaction process. Grant Thornton’s dynamic teams offer range of financial, commercial and operational expertise.

-

Virtual asset advisory

Helping you navigate the world of virtual currencies and decentralised financial systems.

-

Corporate tax

Grant Thornton can identify tax issues, risks and opportunities in your organisation and implement strategies to improve your bottom line.

-

Employment tax

Grant Thornton’s advisers can help you with PAYE (payroll tax), Kiwisaver, fringe benefits tax (FBT), student loans, global mobility services, international tax

-

Global mobility services

Our team can help expatriates and their employers deal with tax and employment matters both in New Zealand and overseas. With the correct planning advice, employee allowances and benefits may be structured to avoid double taxation and achieve tax savings.

-

GST

GST has the potential to become a minefield and can be expensive when it goes wrong. Our technical knowledge can help you minimise the negative impact of GST

-

International tax

International tax rules are undergoing their biggest change in a generation. Tax authorities around the world are increasingly vigilant, especially when it comes to global operations.

-

Research and Development

R&D tax incentives are often underused and misunderstood – is your business maximising opportunities for making claims?

-

Tax compliance

Our advisers help clients manage the critical issue of compliance across accountancy regulations, corporation law and tax. We also offer business and wealth advisory services, which means we can provide a seamless and tax-effective offering to our clients.

-

Tax governance

Mitigate tax risks and implement best practice governance that will stand up to IRD scrutiny and audits.

-

Transfer pricing

Tax authorities are demanding transparency in international arrangements. We businesses comply with regulations and use transfer pricing as a strategic planning tool.

-

Audit methodology

Our five step audit methodology offers a high quality service wherever you are in the world and includes planning, risk assessment, testing internal controls, substantive testing, and concluding and reporting

-

Audit technology

We apply our audit methodology with an integrated set of software tools known as the Voyager suite. Our technology has been developed to produce quality audits that are effective and efficient.

-

Financial reporting advisory

Our financial reporting advisers have the expertise to help you deal with the constantly evolving regulatory environment.

-

Business architecture

Our business architects help businesses with disruptive conditions, business expansion and competitive challenges; the deployment of your strategy is critical to success.

-

Cloud services

Leverage the cloud to keep your data safe, operate more efficiently, reduce costs and create a better experience for your employees and clients.

-

Internal audit

Our internal audits deliver independent assurance over key controls within your riskiest processes, proving what works and what doesn’t and recommending improvements.

-

IT advisory

Our hands on product experience, extensive functional knowledge and industry insights help clients solve complex IT and technology issues

-

IT privacy and security

IT privacy and security should support your business strategy. Our pragmatic approach focuses on reducing cyber security risks specific to your organisation

-

Payroll assurance

Our specialist payroll assurance team can conduct a review of your payroll system configuration and processes, and then help you and your team to implement any necessary recalculations.

-

PCI DSS

Our information security specialists are approved Qualified Security Assessors (QSAs) that have been qualified by the PCI Security Standards Council to independently assess merchants and service providers.

-

Process improvement

As your organisation grows in size and complexity, processes that were once enabling often become cumbersome and inefficient. To maintain growth, your business must remain flexible, agile and profitable

-

Procurement/supply chain

Procurement and supply chain inputs will often dominate your balance sheet and constantly evolve for organisations to remain competitive and meet changing customer requirements

-

Project assurance

Major programmes and projects expose you to significant financial and reputational risk throughout their life cycle. Don’t let these risks become a reality.

-

Risk management

We understand that growing companies need to establish robust internal controls, and use information technology to effectively mitigate risk.

-

Robotic process automation (RPA)

RPA is emerging as the most sophisticated form of automation used to help businesses become more agile and remain competitive in the face of today’s ongoing digital disruption.

We are currently in the process of emailing account holders an update about the liquidation plans for 2024.

This update is as follows and addresses:

- communications from third parties (Epic Trust Limited, the Cogito Metaverse, Principality of Cogito) and assigning/selling your claim

- the use of Cryptopia's confidential information

- the intended timeline for distribution

- an update about the claims process.

1. Communications from third parties (Epic Trust Limited, the Cogito Metaverse, Principality of Cogito) and assigning/selling your claim

We understand third parties have contacted account holders offering to purchase their Cryptopia entitlements in exchange for an obscure digital currency. This agreement requires the assignment or transfer of coins to that third party.

We have been contacted by a number of account holders who are confused about whether these third parties are related to the liquidators, Grant Thornton or Cryptopia. These communications are not from the liquidators and Account Holders should be very cautious of any unsolicited third-party offers, especially from any named above.

We would like to remind all account holders the only channels we use to communicate with them about the Cryptopia liquidation are:

- Our website: https://www.grantthornton.co.nz/cryptopia-limited/

- Emails sent from no-reply@cryptopia.co.nz

- The claims portal: https://portal.cryptopia.co.nz/

- Our Zendesk customer support portal: https://cryptopia.zendesk.com/

If you are unsure whether a communication is an official communication from us, please raise a helpdesk ticket in Zendesk.

Assignment of claims

The sale and purchase agreement offered by these third parties mentioned includes the assignment of coins to that third party.

Under the historic terms and conditions of Cryptopia, we note clause 18.2(b) of Cryptopia's terms and conditions states account holders “may not assign, transfer and/or subcontract any of your rights or obligations under these Terms.” Gendall J relied on these terms and conditions in the liquidators' first directions application in 2020 when he decided the cryptocurrencies were held on trust by Cryptopia for the benefit of account holders.

Our position is the Terms and Conditions remain in force, meaning any assignment or transfer (including by sale) of an account holder's entitlements is not binding or enforceable.

In regards to the assignment of claims, we note Epic Trust Limited, a Montenegrin company claiming to act for the Principality of Cogito, applied to be joined to the liquidators' directions application. The Court declined Epic Trust Limited's application to be joined as a party. The Court's judgment suggests it is possible that:

- The sale and purchase agreements might not be valid, because they do not have legal signatures on them and because the agreement is subject to the laws of the Principality of Cogito, a metaverse that is not a foreign jurisdiction recognised by the Court

- Account holders might not be able to assign their Cryptopia entitlements because of clause 18.2(b) of the terms and conditions

We recommend that any account holders who have entered into a sale and purchase or assignment agreement with any of these third parties seek independent legal advice.

The full judgment regarding the joinder application can be read here: Epic Trust Limited v Ruscoe [2024] NZHC 21 (24 January 2024)

2. Use of confidential Cryptopia information

In 2020, Victor Cattermole obtained confidential Cryptopia information from the High Court. He was ordered to delete and return the information. He was held in contempt of court for breaches of Court orders relating to the information and gave undertakings to the Court intended to protect that information.

The liquidators believe third parties related to him or controlled by him are using the confidential information to contact Cryptopia account holders. Please be assured that we are taking appropriate steps to protect Cryptopia's and account holders' confidential information.

Relating to this matter the judgment and recent interim injunction orders against Mr Cattermole, Epic Trust Ltd and others can be read here:

• Judgement - Ruscoe & Others v Epic Trust Ltd & Others [2024] NZHC 165

• Interim Orders - Ruscoe & Others v Epic Trust Ltd & Others [2024] NZHC 165

Account holders should be very cautious about providing your Cryptopia account information to third parties. The claims portal has been designed to verify each account holder's account ownership and identity, and it is very important this sensitive process is protected.

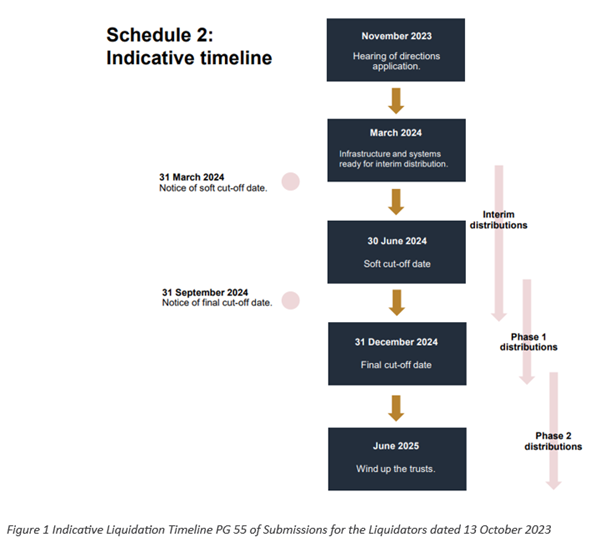

3. Intended timeline for distribution

We remain hopeful that most distributable assets will be returned to eligible account holders by the end of the 2024 year, but the timeframe for distribution will depend on when and what directions the Court makes following the directions hearing in November 2023.

We encourage account holders to read the full submissions to understand the liquidators' intended distribution process: Update for Cryptopia Claimants and Stakeholders 2 November 2023

We have also provided a brief summary below. Please note the Court has not made any orders yet.

Directions Application: The Court heard the liquidators' application for directions about distributing the cryptocurrency to account holders in November 2023. The application covered:

- how the cryptocurrency should be distributed to account holders

- how the costs associated with administering the cryptocurrency trusts should be fairly spread across each coin type and each account holder

- that, after giving reasonable notice, the liquidators are not required to distribute cryptocurrency to account holders who do not register in or complete the Claims process despite the liquidators' best efforts.

Interim Distributions: The first distributions planned by the liquidators will be to account holders with a DOGE or Bitcoin balance of higher than a certain threshold. The distribution will be of 50% of those account holders' cryptocurrency entitlement.

Soft Cut Off Date: After the Court has made a decision about the directions application, the liquidators will give account holders notice of the Soft Cut Off Date. After the Soft Cut Off Date, any cryptocurrency belonging to account holders who have not registered in the claims portal will be considered "unclaimed holdings". The liquidators will use the unclaimed holdings to pay for the costs of trust administration, in the first instance.

Phase 1 Distribution: All account holders who have a balance higher than their initial allocation of trust administration costs and who have completed the claims process will receive a distribution of their entitlement (with a deduction for trust administration costs, if there are any costs left after using the unclaimed holdings). Subject to receiving legal directions, this would occur after the interim distribution currently anticipated Q3/Q4 2024.

Final Cut-Off Date: The liquidators will give account holders notice that all account holders who have registered must complete the claims process. After the Final Cut-Off Date, any cryptocurrency belonging to account holders who have not completed the claims portal will be considered 'unclaimed holdings". The liquidators will use the unclaimed holdings to pay for the costs of trust administration.

Phase 2 Distribution: The liquidators will recalculate how much of the unclaimed holdings can be used to pay for trust administration costs. Account holders may receive a second distribution of cryptocurrency to refund them for all or part of the trust administration costs deducted in the Phase 1 distribution.

We have asked the court to permit us to take no steps to distribute Cryptocurrency that has no value and is unable to contribute to the costs of trust administration.

The diagram below was attached to the submissions filed as part of the liquidators' directions application in November 2023. It sets out a suggested timeline for distribution of cryptocurrency to eligible account holders:

4. Claim process update

The liquidators are advanced in the development of stage ‘4a.’ of the claims process:

| # | Process | Details |

| 1 | Claims registration | Allows the registration of account holders' details |

| 2 | Identity verification | Verifies account holders' identities to the necessary verification standard |

| 3 | Balance acceptance | Provides account holders the opportunity to agree that Cryptopia records represent amounts due |

| 4a | Asset Distribution – Wallet Address Collection | Allows eligible account holders to submit wallet addresses for each balance qualified to participate in Asset distribution |

| 4b | Asset Distribution – Crypto-asset Return | Returns account holders assets proportional to distribution calculation |

Wallet Address Collection will be launched for those qualifying and registered Bitcoin and Dogecoin holders in the coming weeks.

General information

As previously communicated to you, if you are having trouble with the Claims Portal, please raise a ticket through the Cryptopia Customer Support Portal . This support portal is separate from the claims portal and can be accessed by any account holder, provided they register and click the “Sign Up” button on the page.

Lastly, we remind you that the only official communication from the liquidators will be sent from the no-reply@cryptopia.co.nz email. We will not send any communications relating to your claim from a different address. Any communications not sent from this email are not from us and may be scams.