A 10% universal reciprocal tariff has been applied to most imports, currently under a 90-day negotiation window which was set to expire July 9, 2025, however this has since been extended until August 1 2025, providing a temporary reprieve. After this deadline, countries that have not reached bilateral agreements may face country-specific tariff increases, with rates potentially rising to match those imposed on U.S. exports. Chinese origin goods continue to face an effective 55% tariff rate.

For Chinese-origin goods, the situation remains particularly complex. The Reciprocal tariffs which were temporarily reduced from 125% to 10% on May 12, are scheduled to revert to higher levels on August 12, 2025, unless further negotiations alter the timeline. Additionally, a 20% tariff on all fentanyl-related products from China remains in effect under the International Emergency Economic Powers Act (IEEPA)

In parallel, Section 232 tariffs on steel, aluminium, and automotive parts have been doubled from 25% to 50%, effective June 4, 2025. These increases also apply to derivative products, meaning vehicles assembled in the U.S. using imported components may still be affected. However, certain sectors—such as copper, pharmaceuticals, semiconductors, lumber, critical minerals, and energy products are currently exempt from these new measures. The 301 Tariffs of 7.5% or 25% are still applicable along with the Most Favoured Nation Rates which are calculated based on the HS Code of the imported goods; on average, this is 3.3%.

Legal challenges have added further uncertainty. Recent rulings by the U.S. Court of International Trade and a D.C. district court have questioned the legality of tariffs imposed under IEEPA, though enforcement continues pending appeal

The broader implications for New Zealand and Australian multinational businesses exporting to the United States are considerable. The current trade environment is highly volatile, with new tariffs and retaliatory measures being introduced on an almost weekly basis. While this reflects the situation as of today, the unpredictability of future developments makes it impossible to forecast conditions with certainty in the coming weeks or months. This underscores the critical importance of ongoing monitoring and strategic responsiveness to global trade shifts.

Impact on trade and business operations

Historically, New Zealand has maintained a strong trade relationship with the US. Although services provided to US-based customers are not included, businesses involved in the movement of goods into the US will feel the impact, directly or indirectly.

Prime Minister Christopher Luxon has continues to indicate that New Zealand will not impose retaliatory tariffs on US imports which means businesses sourcing from the US should not experience a direct impact. However, it is crucial for businesses to understand the changes and their potential effects on supply chains, customs obligations, and pricing mechanisms.

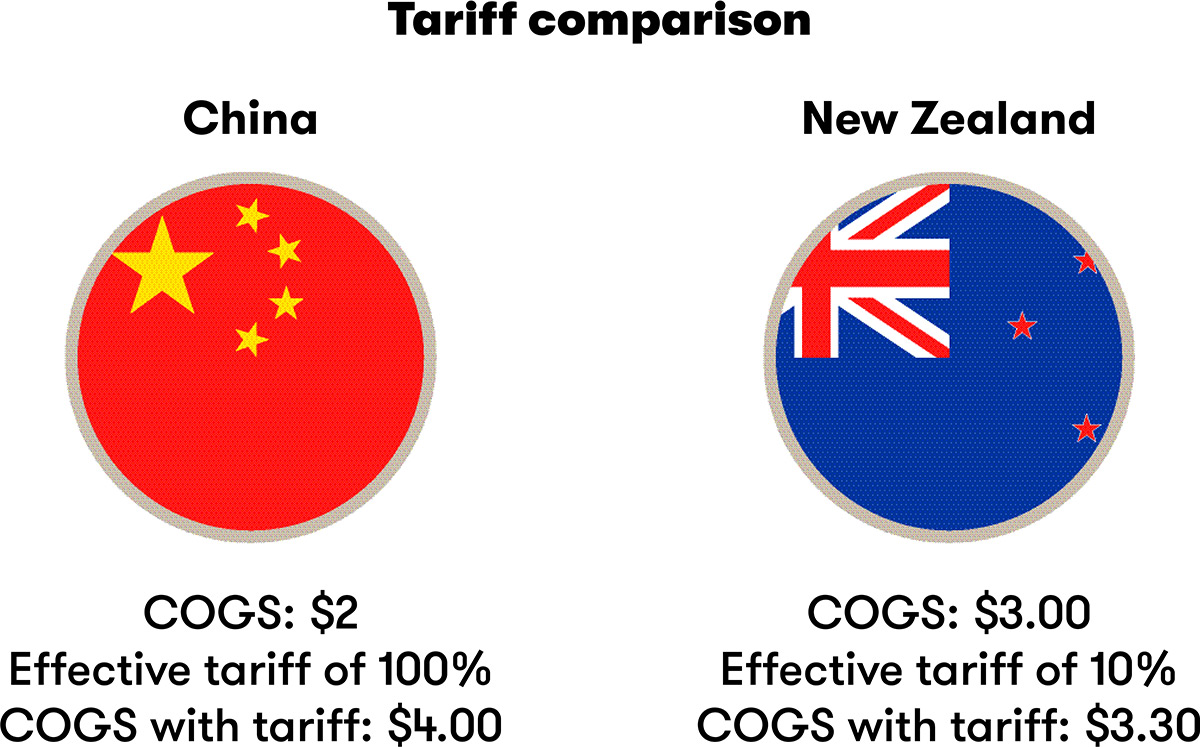

Theoretical demonstration of cost of goods sold implications and potential impacts to trade.

While the scenario outlined above was a closer reflection of the global trade environment as it stood just over a month ago, recent developments underscore the volatility of international markets and the evolving landscape of tariffs. These rapid changes highlight the critical importance of ongoing monitoring and analysis of global trade dynamics. Until the US administration achieves greater policy stability and formalises or renews key trade agreements, businesses must remain vigilant to ensure compliance and strategic alignment with shifting regulatory frameworks.

According to Grant Thornton’s International Business Report, at the end of 2024, 54.6% of global midmarket businesses were planning to increase their exports and approximately 50.3% were expecting revenue growth. Instead, we saw the first notable dip in two years, down 2.9%. The global tariff and trade landscape is constantly changing, with tariff adjustments and announcements coming out of the US almost weekly, coupled with retaliatory tariffs from impacted countries. With the shift in traditional global export markets, organisations need to maximise their value in domestic markets and look at doing business in a more regional capacity until things settle.

In addition to tariffs, the US administration has decided to remove the $800 'de minimis' loophole. As a result, imported parcels below this threshold entering the US will be subject to a 120% tariff or a flat fee of $100, which increased to $200 in June. This is in addition to the 55% tariff already imposed on select Chinese imports.

Short-term strategies for mitigation

This is the first instance of volatile trade conditions in years where midmarket firms haven’t been able to focus on their portfolio of non-domestic business to grow despite market turbulence. Their ability to respond swiftly to new challenges and pivot as required is crucial. Strategic shifts are already being observed, with many companies electing to concentrate on a select few markets with the most promising prospects. The number of companies businesses are looking to sell to has already decreased.

In the short term, businesses should focus on gaining clarity over their supply chains. This involves ensuring robust data about what is declared to customs authorities based on Harmonised System (HS) codes and valuation methods is recorded. This data can then be used to model impacts and determine cost implications. Additionally, examining contractual pricing with suppliers and customers will help ascertain whether tariff costs can be absorbed or passed on.

Evaluating current and alternative customs value pricing strategies can provide simple solutions to mitigate or defer duty liabilities. Ensuring country of origin claims are supportable is also critical to tariff management. Optimisation of all available duty and tax incentives throughout the supply chain can help effectively manage costs.

Long-term considerations and transfer pricing implications

The imposition of these tariffs introduces several technical and practical challenges, particularly for multinationals with US operations. In the longer term, businesses may need to explore alternative export markets to reduce dependency on the US, shift supply chains, and consider alternative transfer pricing policies.

For many Australian and New Zealand businesses, these tariffs will affect more than just the immediate costs of doing business. They will likely influence profit allocations, tax liabilities, compliance exposure, and potentially trigger double taxation disputes. Multinationals exporting goods to the US via related-party structures must carefully manage the transfer pricing implications of these new tariffs.

Attempting to compete in tariff-heavy markets may not be sustainable. Businesses may need to make the call to scale down or halt trade in markets where tariffs are going to continue.

Key transfer pricing considerations

These tariffs may prompt multinationals to rethink their country of production and broaden supply chain strategies. Existing intercompany agreements may not clearly allocate responsibility for unanticipated tariff costs, necessitating review and possible amendments to clarify responsibility, consistent with arm’s length principles.

The 10% reciprocal tariff will directly impact the cost of goods sold by US distribution subsidiaries. This may erode target profit margins, potentially driving the US entity into a loss-making position and triggering transfer pricing adjustments. Businesses must consider whether existing transfer pricing policies and Advanced Pricing Agreements remain appropriate or if price adjustments are required.

This tariff is not necessarily detrimental to Australia and New Zealand exporters. For certain products there is the opportunity for relative cost of goods sold (COGS) to be lesser than those of competing exporters. For example, if the tariffs placed on French wine exceed that of the 10% rate placed on New Zealand - assuming both exporters elect not to absorb tariff costs - the New Zealand wine is now comparatively cheaper than the French product, which means the quantity demanded for our wine will exceed that of the French; New Zealand products are now “more competitive” relative to competing exporters, and are relatively cheaper.

Engagement with government and industry bodies

Sharing information about the commercial and financial impacts of the tariffs with government agencies such as Austrade, the Ministry of Foreign Affairs and Trade (MFAT), the Department of Foreign Affairs and Trade (DFAT), and NZTE is crucial. Coordinated industry engagement will support bilateral discussions and dispute resolution efforts.

More tips for navigating tariffs

There are several ways businesses can reduce the impact of increased costs and supply chain disruptions, while also identifying competitive opportunities and synergies for optimisation and compliance requirements.

Data analysis within your customs team

- Drawback analysis: Duties paid on imported goods that are subsequently exported can be identified and reclaimed

- FTA analysis: Assess the benefits of various Free Trade Agreements (FTAs) to ensure the business is leveraging all available duty reductions.

- Tariff re-engineering: Optimise tariff classifications and explore duty exemption schemes to minimise costs. For example, reclassify certain exports so they fall into classifications that face a lower tariff rate. This may require specialised classification and subclassifications of goods.

- Origin verification: The origin of goods can be verified to maximise the benefits of FTAs and other duty programs and ensure compliance with rules of origin.

- General compliance: Ramp up customs compliance activity including the disclosure of transfer pricing adjustments.

Procurement strategies

- Direct procurement: Develop multi-sourcing relationships, negotiate volume-based price protections, and explore material substitutions to reduce dependence on tariffed inputs.

- Indirect procurement: Manage tariff-driven cost increases effectively across software, facilities management, logistics services, and other operational expenses.

Transfer pricing

- Transfer pricing policies review: Review existing transfer pricing policies, how they impact the price of related party dealings, and the impact they have on goods declared for customs duty purposes.

- Optimise supply chains: Review global supply chains, analyse sales transaction flows versus physical transaction flows, and align characterisation of group entities for transfer pricing purposes to help adapt the organisation’s operations effectively.

Wider economic impacts to the global economy and the US domestic market

The imposition of universal tariffs by the US represents a significant commercial and financial challenge for Australian and New Zealand exporters. Beyond the immediate trade, operational, and economic impacts, these tariffs have far-reaching consequences for transfer pricing policies, tax compliance, and financial reporting. With proactive review and strategic action, businesses can manage these risks and ensure their transfer pricing arrangements remain robust, defensible, and aligned with arm’s length principles.

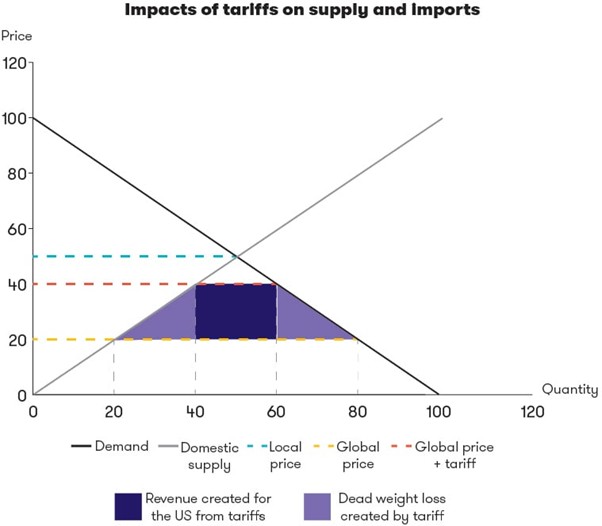

The graph above shows how tariffs increase the price of goods, shifting the quantity demanded for imports. The impact of tariffs varies by country. For instance, US tariffs on China have a far greater effect than those levied on New Zealand assuming the graph above is for the effect of tariffs on New Zealand (ie, the purple area - tariff revenue) would visually be far greater.

The illustration of US tariff revenue assumes perfect theoretical conditions, which means such estimated revenue from the tariffs is not guaranteed. Instead, there may be a shift away from exporting to the US towards other economies due to higher associated costs.

Looking at the COGS examples of imports into the US between New Zealand and China, a similar comparison can be drawn between China and US in relation to New Zealand, the tariff price to export goods to the US vs China is going to differ, China is going to import, sell and price goods from New Zealand at a lower cost than the US will, relative to the new tariff imposition.